Peer volume customer pressure, China's filter industry survival is urgent

发布时间 : 2023-10-16

This is a good season for the shipment of "gold nine silver ten", many filter companies are not happy.

Because a filter with a unit price of three cents means a loss of 30%-50%, selling more may mean a much bigger loss.

Chaodian think tank understands from the industrial chain that the extreme internal volume of the industry, as well as the extrusion of downstream camera module customers, are the two major promoters of China's filter industry on the cliff.

From this year's report, five party photoelectric (002962), crystal photoelectric (002273), Dongtian Micro (301183) and other filter listed companies are both profitable. You know, the first two are important suppliers of camera filters for Apple's iPhone.

For more unlisted companies that lack access to financing and support from overseas orders, life is naturally difficult.

"Even if we have the support of overseas customers with higher profit contribution, the loss rate is now more than 40%, and some friends who only do the Chinese local market are even worse." Wu Quanfa, a senior executive of a filter manufacturer in Shenzhen, believes that if the ecological environment continues to deteriorate, the filter will lose the living space of the group, and China's camera manufacturing industry may "break the chain" phenomenon.

The key question is, how to solve the current "life and death"?

01 From highlight to dark

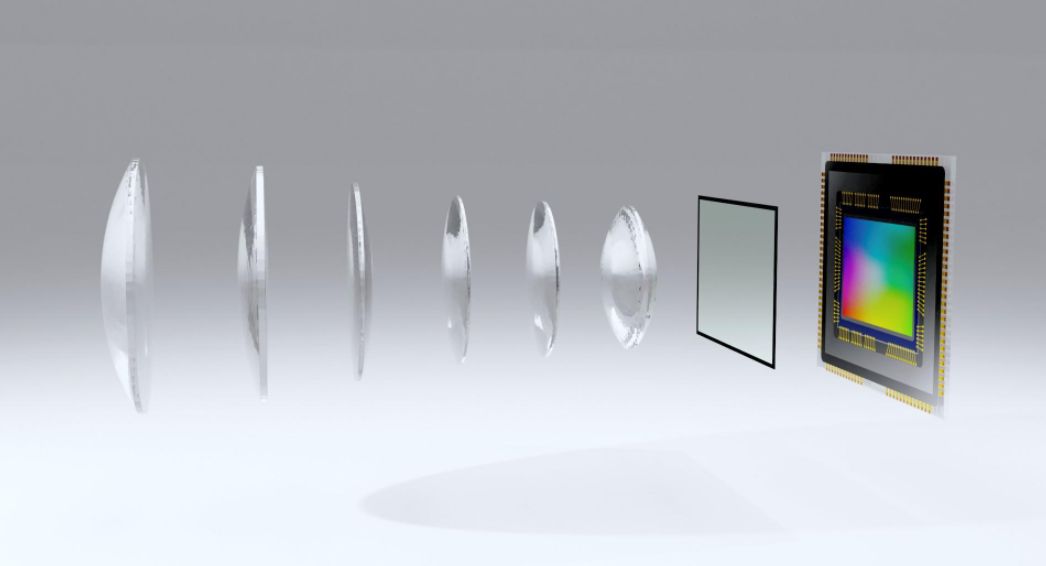

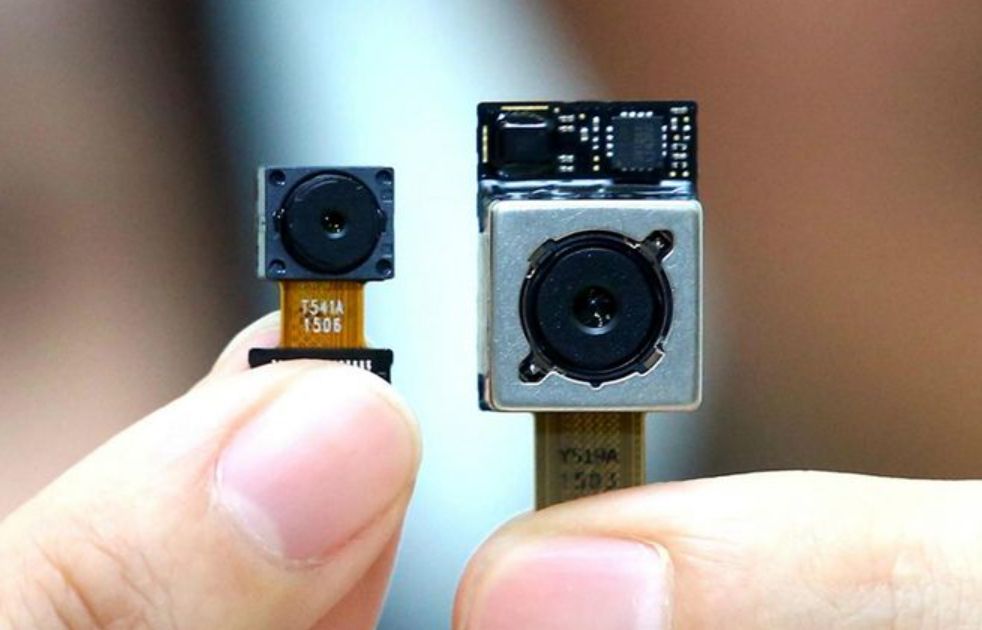

The core structure of mobile phone optical camera is mainly composed of CMOS chip, lens, motor, module and filter as the main structure. In contrast, although the filter component is also indispensable, it lacks a sense of presence because the cost accounts for only 3%-5%, and it currently has a small voice in the camera industry chain.

Lengthening the dimension of time, the filter actually has its own highlight moments.

Li Hua, who has been in the filter market for more than 10 years, is now the sales person in charge of a mainstream filter company, according to his recollection, "The industry broke out with the smartphone market, and the unit price of the earliest blue glass filter products exceeded 5 yuan." From 2014 to 2018, after the scale of market demand, the unit price of the filter was stable at more than two pieces, but the material cost accounted for only about 20%, and manufacturers maintained a relatively considerable profit margin."

Too bad it didn't last. Beginning in 2021, the darkest hour will arrive.

At that time, with the contraction of global smartphone terminal sales as a sign, the low-price grab single popular to bring the supply chain extreme volume, the filter industry has not been spared, the market unit price of the product fell 90% to about 0.3 yuan.

Li Hua calculated such an account to the Chaodian think tank: now a 77*77 standard specifications of blue glass substrate in the procurement cost of 15 yuan, plated film after the bidding price of the medium is only 17 yuan. Among them, the industry's higher production through-rate is controlled between 85% and 88%, so the cost of raw materials with loss accounts for as high as 98%, coupled with various expenses such as labor, electricity, and rent, it can be said that each enterprise is suffering from terrible losses.

From the perspective of capital operation, professional securities analyst Yang Sheng believes that for many listed companies, business indicators such as order holdings and revenue scale have the most practical significance for maintaining and improving the company's stock price and market value in the short term. "Grabbing market share at low prices has become a common phenomenon. To some extent, because listed companies have relatively sufficient cash flow, the more listed companies in the field, the easier to get involved."

The 02 phase is too fast

The almost streaking market unit price is dyed red by a round of price wars.

According to public data, in the first half of this year, the revenue of Wufang Optoelectronics was 376 million yuan, a decrease of 29.5%. Net profit was 33.17 million yuan, down 19.54% year-on-year. Crystal Optoelectronics revenue of 1.854 billion yuan, slightly down by 1.63%; Net profit was 177 million yuan, down 27.72% year-on-year.

Driven by Apple, a major customer, Wufang Optoelectronics' overseas revenue accounted for 87.14% during the reporting period, and Crystal Optoelectronics' export revenue accounted for 75.62%, both of which increased year-on-year.

Of course, in the team that follows and runs with them all the year round, the most helpless and painful are those non-listed companies with limited capital, research and development and customer resources.

In Li Hua's view, "Some listed companies are full of doctrine in their mouths, but their hearts are all business." They suppressed the market by vicious means such as price reduction and credit, seriously damaged the ecological environment of the industry, and became the initiator of the industry's internal problems."

According to Chaodian think tank, filter manufacturing is a typical heavy asset industry, such as the purchase of an imported light coating machine about 4 million yuan, a fully automatic radium engraving and cutting machine needs to invest about 2 million yuan.

Wu Quanfa's filter products have a monthly shipment of 15KK level, and many orders have to be accepted knowing that they are losing money. "If production stops, the production line of equipment worth hundreds of millions of dollars will become scrap iron, and the employees who have followed the company for many years will also face unemployment."

03 The wool is collected downstream

Filter is the most mature link in the current camera industry chain to replace Chinese production, in addition to mobile phone brands and ODM fixed points, the main orders from downstream camera module manufacturers.

According to Chaodian think Tank, compared with camera lenses, chips, motors and other industries, affected by the terminal order and bidding system, the module plate has also faced a certain pressure in recent years, which can be reflected in the financial data of the head camera module manufacturers such as Sainyu, Qiuti, and Ofei.

"This should not be a reason for module manufacturers to pass on risk and stress to filter suppliers." Li Hua somewhat resentful said, "Many terminal manufacturers in the camera module bidding project, there is a budget for the purchase price of filters, such as 0.4-0.7 yuan/piece, but the module manufacturers to our actual purchase price is almost 60% discount, or even lower."

Wu Quanfa believes that the practice of large areas of downstream customers "pulling wool" is tantamount to worse for the already dismal filter industry, and the living environment is harsh to the extreme.

From the optical industry chain, since the second quarter of this year, the mobile phone camera module market has ushered in a wave of price increases, and the unit price of many specifications has been adjusted back to a certain extent.

A number of filter manufacturers told the tide think tank that now we urgently need to replenish blood, but we have not yet received any information from downstream customers about product price increases.

China shipped 124 million smartphones in the first half of this year, down 7 percent year-on-year, according to data released by the China Academy of Information and Communications Technology. Chaodian think tank statistics, the first half of the global smartphone sales of 520 million units, down 13.3%; Market sales have declined year-on-year for eight consecutive quarters.

Even the longest winter will pass. The most frightening thing is that when the spring is ready to whip the horse, the cornerstone of trust between the two sides has been lost.

In September, Huawei Mate 60 series and Apple iPhone 15 series war, so that the weak mobile phone industry topic many times on the hot search. From the mobile phone supply chain related shipments, the second half of the market is also showing signs of rebound.

Chaodian Think tank believes that the upstream and downstream prosperity of China's smartphone and even the entire consumer electronics industry is the key to stability and long-term development.