Car CMOS leading ON semiconductor layoffs and revenue reduction, SONY, Howway and other seven new and old players grasp the position

Time : 2023-11-16

The most difficult times, the car demand strong support of the CMOS market.

Market data show that due to the downturn in demand for mobile terminals, global CMOS sensor sales fell for the first time in 13 years in 2022, reaching $19 billion, down 7% year on year. But the car segment grew by 39%, making it the second largest segment after mobile phones.

As the leading vehicle CMOS market for many years, the recent news of ON Semiconductor "downsizing 900 people again" has become the focus of the industry.

However, it is not yet time for other in-vehicle CMOS companies to party.

According to the earnings announcement, On Semiconductor's third-quarter revenue was $2.18 billion, down 0.54 percent from the same period last year. By business segment, automotive chip revenue rose 32.5 percent year on year to $1.158 billion, a record high. That is to say, on-board CMOS is still the biggest excitement of its revenue.

At present, SONY, Howway, Geke micro, Steway and some new manufacturers have strategic layout in the field of vehicle. Chaodian think tank believes that in the past, the market situation of Onsen Mei will not be repeated, and the car CMOS will enter the era of competition until the terminal car companies complete the reshuffle.

A $30 billion market segment

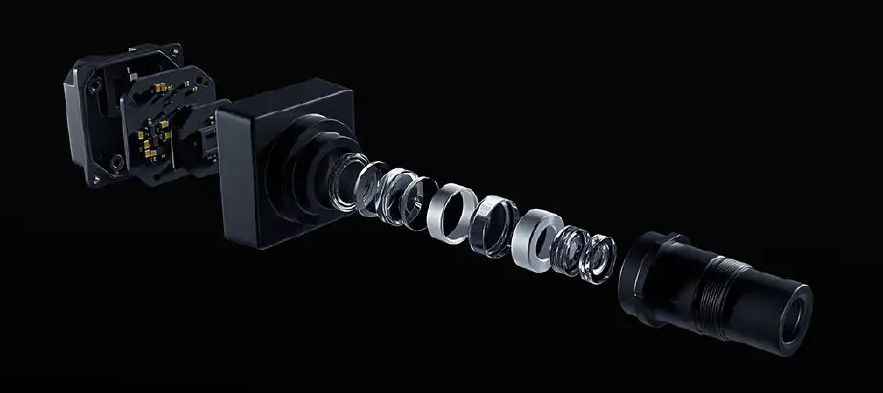

According to the recent driving report of two representative cars, Polar Yue 01 and Xpeng G9, released by a professional evaluation agency, the camera pure vision scheme still occupies the absolute core position of intelligent driving.

Chaodian think tank predicts that in the next three years, the vehicle CMOS market demand will maintain a compound growth rate of about 40%. In 2025, the global vehicle camera shipments will exceed 700 million, and the related automotive CMOS market size is close to 30 billion yuan.

From the perspective of application scenarios, the on-board CMOS can be divided into four types according to the installation location: front view, back view, inside view, and side view. In the ADAS function models represented by the new forces of car manufacturing, the distribution of on-board cameras is now mainstream: 1 forward view, 1 backward view, 4 side view, and 1 inner view.

By 2025, the average number of CMOS chips used in each level 3 autonomous vehicle will reach 9. At the higher levels of L4 or L5, the number of CMOS required for the bike will double, possibly up to 20.

According to the analysis of industry organizations, is expected to the end of this year to the first half of next year, the semiconductor market will gradually recover, including the car market will drive a new round of CMOS scale rise, become a must for chip manufacturers.

From the feedback of related supply chains such as on-board camera modules and lenses, domestic manufacturers are expected to take the lead.

A senior executive of a first-tier vehicle optical manufacturer in China anonymously revealed, "before the product did not start, many times need to look at the face of overseas manufacturers, order demand is often ignored by the other side. Now after the increase in shipments, some foreign companies even put up with the situation of strong cooperation, which is difficult to tolerate."

At the level of terminal car companies, the pressure of "burning money" has been increasing in recent years, and reducing costs and increasing efficiency has become the main theme of the industry. Therefore, more domestic CMOS manufacturers have entered the rims supply chain system with more competitive price, delivery and service capabilities.

A big bet in the chip world

As the most stable growth point at present, the charm of vehicle CMOS in the field of semiconductor chips is the same, attracting a number of domestic and foreign strength manufacturers to invest heavily, including SONY, Samsung, Geke micro and other giants of mobile phone plate, as well as new players such as Inchip semiconductor and Yuan Shixin.

According to the understanding of tide power think tank, CMOS manufacturers are strengthening the layout of the field of car specifications, and the cooperation between the major local automakers is becoming more and more close. In this regard, China's intelligent vehicle development is located in the global highland, has a unique terminal advantage.

01 SONY

According to SONY's plan, the investment in CMOS will be about 900 billion yen (about 43.6 billion yuan) by 2024, and the share of the global CMOS market will increase to 60% by 2025.

To achieve this monopolistic goal, in addition to the largest mobile phone main battlefield, SONY's expansion in the car territory is essential.

On September 12 this year, SONY released a new 17.42 million pixels, suitable for intelligent driving car CMOS sensor "IMX735". SONY and Honda have formed a joint venture called "Sony-Honda Mobility," which is expected to mass-produce electric vehicles by 2025 and will be equipped with SONY's automotive CMOS products.

02 SamsungIn the automotive sector layout has lagged significantly, but now become a secondary supplier of Hyundai Motor, will supply CMOS chips for its latest models. Samsung also has car power chips, processors, video driver IC, etc., a complete product line of competitive advantages should not be underestimated.

As early as 2008, it mass-produced the first automotive CMOS, 10 years ahead of SONY. According to public information, at present, the automotive CMOS of Howway Technology is mainly used in RVC, ADAS, SVS and other systems, and its customers include mainstream automakers such as Mercedes-Benz, BMW, Audi, and GM.

04 Stevi

As a result of the main business security market downturn, Steveway's operation in recent quarters has been affected to some extent. Since entering the automotive electronics field in 2020, the company has launched more than 10 vehicle-standard CMOS products in a row, which is also determined to win the car market.

In a recent survey, Stway said that the company's vehicle CMOS products have been mass-produced in BYD, FAW, SAIC, Dongfeng Nissan, Great Wall and other customers.

05 Gekwei

In the hot field of automotive electronics, Geke Micro said that it is vigorously promoting the relevant certification work, and strive to complete it by the end of this year. Up to now, Geke Micro has successively launched three new products of smart city and automotive electronics based on 65nm+CIS technology platform.

Incore Semiconductor

Founded in May 2019, the company mainly provides CMOS chip design services, including fingerprint, ToF 2D/3D face, iris recognition and other biometric systems, and even human DNA biochips, Li-Fi wireless optical communication VLC chips and other advanced product development and design services.

In October this year, Incore Semiconductor was successfully selected as "Guangzhou's first 100 New Enterprises". According to Chaodian think tank, the company currently has a relevant layout in the field of vehicle, and smooth progress.

07 yuan visual core

It is one of the representative enterprises newly entering vehicle CMOS. Its vehicle-level products are expected to cover 1.3M, 3M, 8M, 14M+ and other specifications to meet the electronic rear-view mirror, 360-degree panoramic imaging, ADAS and other fields.

The first chip in the MAT series developed by Metvision is a 3M image sensor with built-in ISP, which is specialized in enabling application scenarios such as panoramic view, ADAS peripheral view, automatic parking and electronic rearview mirror. In addition, the company is preparing to launch vehicle products, will mainly be more advanced 140dB ultra-high dynamic and 60fps high frame rate as the core performance characteristics.

The trend of smart driving is irreversible. "Eight imonians cross the sea, each has his own talents", who will become the new CMOS navigator?