Top 10 Trends in the Camera Industry by 2024

Time : 2024-01-10

The back of 2023 has gradually faded away, the optical camera industry has a new start, and the market size will sprint to 10 billion in 2024.

The last few years have been rough for optics players. Although the car track continues to increase, it is far from the downturn of the mobile phone's main battlefield, until the freezing point in the first half of last year.

The biggest memory point of the mobile phone market in 2023 is the Huawei mate 60 series reheating industry chain in September. Chaodian think tank believes that the deeper reason is that the consumer economy is picking up, terminal manufacturers generally complete the inventory work, and a new round of industry cycle is coming.

After the structural components such as lenses, modules, CMOS chips, filters and other market price adjustments, the development of the camera industry in 2024 will show a multi-faceted, in addition to the full penetration of mobile phones, vehicle, security, XR and machine vision and other segments, the technical end of the infighting will be upgraded again.

01 Glass plastic hybrid lens rise

The mobile phone space is squeezed by CMOS chips, anti-shake motors and other structural parts, and injection molding technology is difficult to break through quickly, and the performance improvement of multi-P plastic lenses will be limited.

Compared with plastic lens, glass-to-plastic hybrid lens has the advantages of larger aperture, higher analytical power, lower thickness and low temperature bleaching. According to the understanding of Chaoda Think Tank, after years of precipitation and accumulation, glass-to-plastic mixture has gradually matured and can be used as a powerful supplement to the mainstream lens product line in 2024.

02 Latent technical reflux

The biggest highlight of the iPhone 15 is that the flagship model is equipped with the latent lens for the first time, and Huawei Mate 60 is also designed with the latent lens, and the heat and prospect of this technology are fully optimistic.

According to the tide Power think tank, Huawei, OPPO, Xiaomi, vivo and other mobile phone manufacturers have launched smart phones equipped with periscope heads three or four years ago. In the field of stealth and telephoto lenses, the Android camp is "far ahead."

The competition for smartphone imaging technology in 2024 is more intense, and the possibility that Android will fully follow the periscope head is very large.

03 Bloody Battle 50 million pixels

From the perspective of the supply chain stock situation, the 50 megapixel camera is still the most stable and reliable configuration for the main/rear camera of the mobile phone in 2024. Whether it is the self-developed algorithm system of the brand manufacturer, or the hardware grinding of the optical camera manufacturer, 50 million pixels is the most competitive battlefield.

From the development trend point of view, whether it is e-sports games, female users and other market segments, or the amount of thousands of yuan "bucket machine", 50 million pixel main photography is popular, millet, OPPO, vivo, etc., is the 5P/6P high-end flagship image down.

04 Japanese and Korean manufacturers were blocked

After achieving its 32 million pixel product volume of a single chip, Geke Micro launched a 50 million pixel CMOS of a single chip at the end of last year.

Including Howe and Steway, this means that high-end mobile phone CMOS has fully equipped with domestic supply capabilities, and has more competitive advantages in delivery, service and cost. In 2023, it has been reported that SONY and Samsung will greatly reduce the cooperation resources with Chinese Android.

VCM motor supply, blue Electronics, new thinking and other manufacturers in the high-end market has also gained a foothold, can be positive hard just Japan and South Korea, the rise of domestic substitution trend.

05 Variable aperture

In the history of mobile phones, Nokia introduced the variable aperture design for the first time in the N86 launched in 2009, providing F2.4, F3.2, F4.8 three stops that can be automatically adjusted. For ordinary consumers, variable aperture has always been a plus in the purchase, not a necessary option.

After CMOS came to an inch in the last year or two, the practical application value of variable aperture on mobile phones has changed. With the upgrade of the intelligent image battle, the professional variable aperture technology will be rapidly lowered, which will usher in a major breakthrough in 2024, and may even become the flagship product standard.

06 Centralized order resources

As upstream optical manufacturers have slowed down in terms of controlling the scale and investment cycle, resulting in a decline in the total supply, terminal brands have made continuous adjustments to the bidding price for the procurement of mobile phone camera devices in 2023.

In the new round of market game, the head manufacturers will launch a more powerful strangling with the advantages of supply scale cost and automated production.

Chaodian think tank was informed that in 2024, the play has changed, and the large factory will generally be responsible for the production of high-end and specific customers, and the orders with lower specifications will be transferred to third parties.

07 Car product prices down

With intelligent driving as the driving force, in recent years, the on-board camera as the most mainstream visual system has increased rapidly, but on the other hand, the price of the product is not slow.

First, car companies have become more rational in "burning money", and the cost control of the supply chain has been greatly strengthened in the terminal. Second, more suppliers have crossed the threshold of car regulations and are anxious to squeeze into the

The trend of price reduction will become more obvious in 2024, and the blue sea of car cameras is gradually changing into the red Sea.

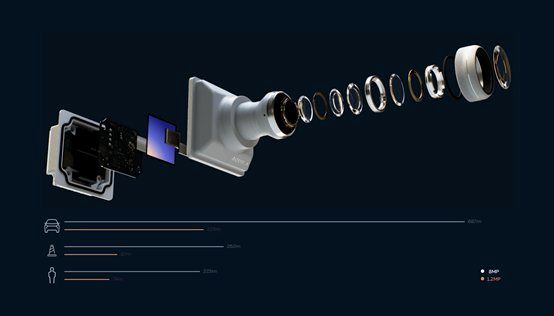

08 High-end 5M/8M acceleration on board

Wei Xiaoli, polar Krypton, Nezha and other new car-making forces have already taken the lead in carrying 8 million pixel ADAS cameras, but the real high-end scale effect is still marked by BYD and Tesla's two leading car companies that have been equipped with cameras of more than 5 million pixels. In addition, the round-view camera will advance from 1M to 3M and become mainstream.

At present, the automatic driving stage is gradually evolving from L2 to L5, and the high-class intelligent driving scheme has gradually become the basic configuration of manufacturers to develop new products. The automotive industry predicts that 2025 is the big node of the reshuffle, so this year, the high-end intelligent driving program of some terminal brands may be more crazy and radical with the support of large computing power.

09 Security industry demand picks up

09 Security industry demand picks up

Due to the completion of the phased construction of the national smart city and related hardware in the past few years, the security industry was once regarded as the camera application has touched the "ceiling" industry, but driven by the "AI+5G" intelligent upgrade, coupled with home-level demand growth, the security camera market has bottomed out and is rapidly picking up.

China is the world's largest market for security cameras, which is expected to grow to 800 million by 2025. It is worth noting that the product requirements of security cameras are getting higher and higher, and they need to have performance characteristics such as high temperature resistance, high definition, remote monitoring, low illumination performance and reliability.

10 Machine vision /XR starting volume

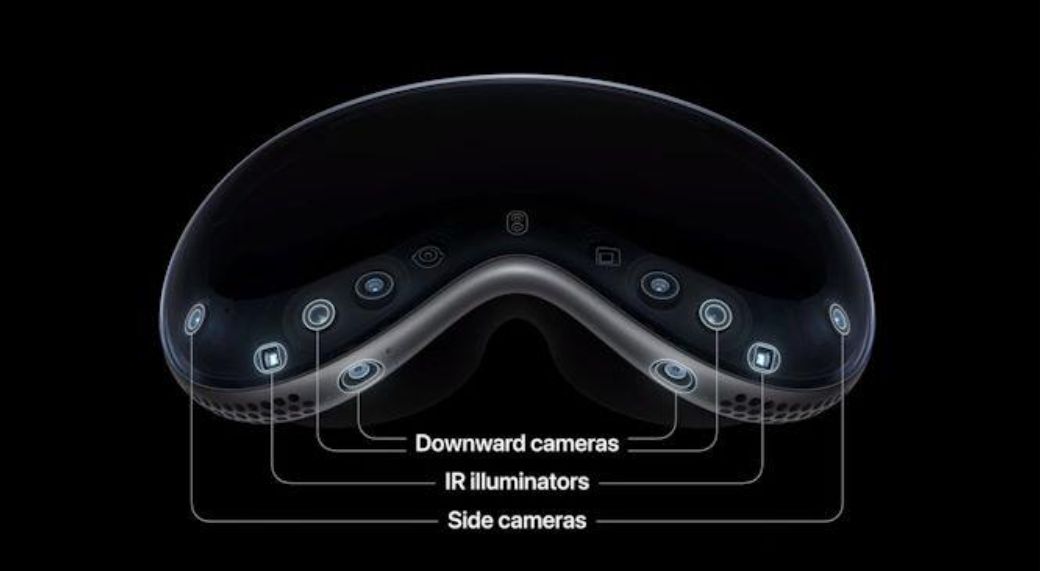

Mobile phones, cars, and security are the three main battlefields for cameras at present, but other segments also have broad growth prospects, among which machine vision and XR are the most promising.

The demand of machine cameras can not be ignored, compared with civilian products, it has the advantages of high image stability, high transmission capacity and high anti-interference ability.

Sales of Apple's first headset in 2024 can be seen as a barometer of the XR camera market. According to industry organizations, the future single consumer XR headset device will be equipped with at least six different cameras, the relevant camera shipments will grow at an average annual rate of 41%, 2026 will be more than 200 million.